If they ask you to continue paying the original creditor, it’s likely the debt will still be owned by them. You can usually tell which of these applies by checking where letters from the debt collection agency ask you to send payment. The collection agency will often be paid a percentage of the money they collect.

The original creditor still owns the debt, but they use a collection agency to contact you. The collection agency becomes the legal owner of the debt and makes their profit by collecting the whole amount from you.Ģ. They sell the debt at a reduced amount so they get a lump sum of money. The contract you signed with the original creditor allows them to do this after your account has defaulted. The original creditor sells or ‘assigns’ your debt to the collection agency because the amount you’re paying isn’t enough for them. Others are very large companies operating across several countries.ĭebt collectors usually work in one of two ways:ġ. Some are small and specialise in collecting only certain types of debt. There are many debt collection agencies in the UK. an e-mail from the debtor).Ĭontact us for more information about debt collection in Italy.Debt collection agencies are companies who specialise in collecting debts where the original creditor can’t get arrears repaid. a “provisionally enforceable order” can be generally obtained if we provide to court a bill of exchange, a cheque or a bank draft, or an admission of debt (e.g.a power of attorney signed by the legal representative of the company giving us the power to represent you before the court, translated into Italian and apostilled or legalized.This document shall be certified by a public notary in country of residence of the creditor, translated in Italian and apostilled or legalized. an extract of the company’s accounting records which show the relevant invoices.copy of the waybills (if applicable) or any other suitable documents to prove that you have regularly supplied the goods or given the services.copy of the title (contract, cheque, order, bill etc.) from which your credit has originated (if the documents are not in Italian, court will require a translation in Italian).In order to obtain a Court injunction order, we shall provide to Court the following documents:

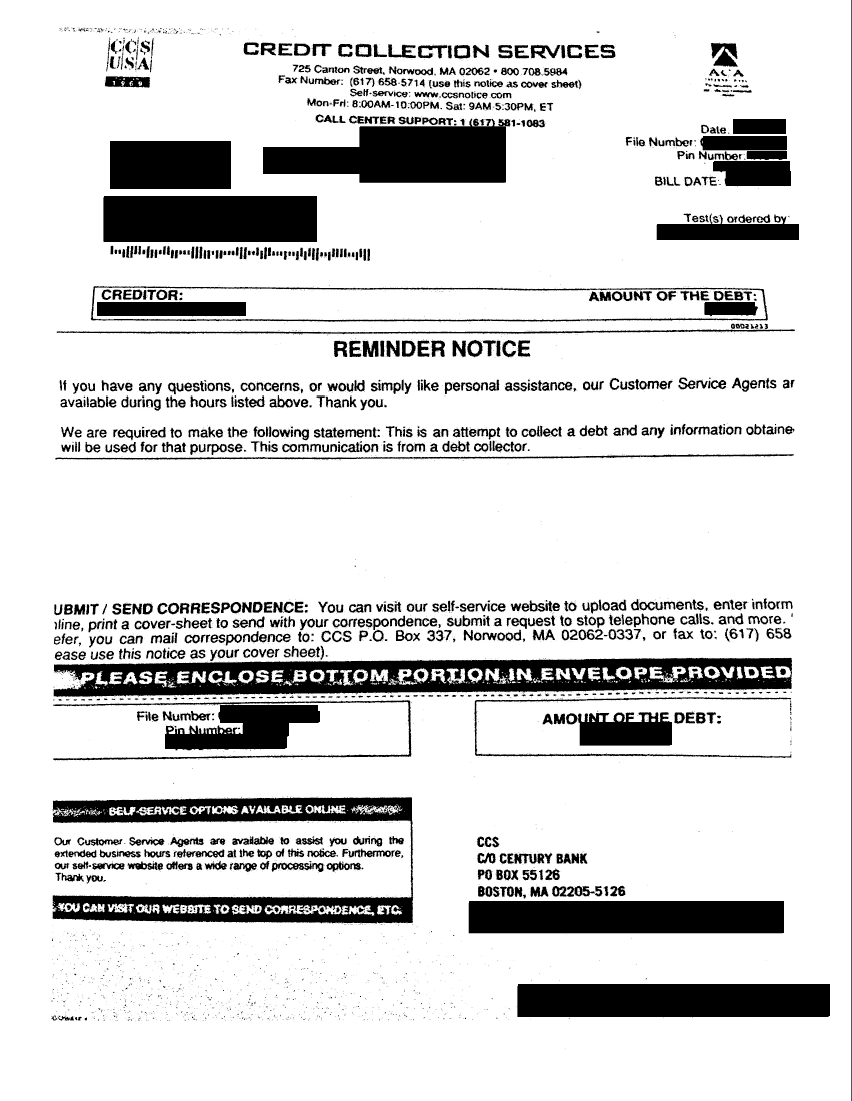

CREDIT COLLECTION SERVICES TRIAL

The main issues to discussed in such a trial will the legitimacy of the court injunction order (mainly formal aspects) and the title of the credit.

Under Italian law, debt recovery requires the following stages: Our team of qualified lawyers regularly assist international clients with both civil and commercial disputes related to debt collection.

Open a limited liability company in Italy.

0 kommentar(er)

0 kommentar(er)